Up to

100% Fee Waiver

To Study in India

No tuition fees.

Just pay for your accommodation & one-time charges

Our Partner Universities

Key points about this Fee Waiver.

This Fee Waiver aims to admit deserving students and reward them with fee concessions. Total number of scholarships: 200 (30 per country maximum)

Type

Up to 100% on tuition fees

Offered By

Indian Universities

University Type

Not for Profit (Private)

Selection Type

Application-Based

Study Type

Study in India

Degree Awarded by

Indian Universities

Program Starting

From August – September

Program Level

Diploma, Bachelor & Master

About this Fee Waiver

Fee-waiver opportunities

Programs

Universities

Book A Free Counselling Session

Join an online meeting with our counsellor along with your parents to understand the admission process better.

✔ Get a Globally Recognized Degree

✔ Study in World-class Infrastructure

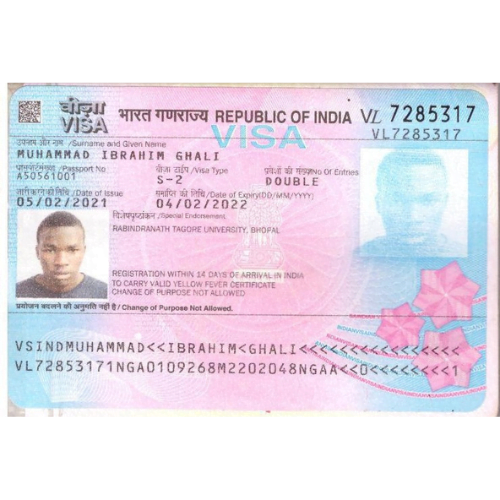

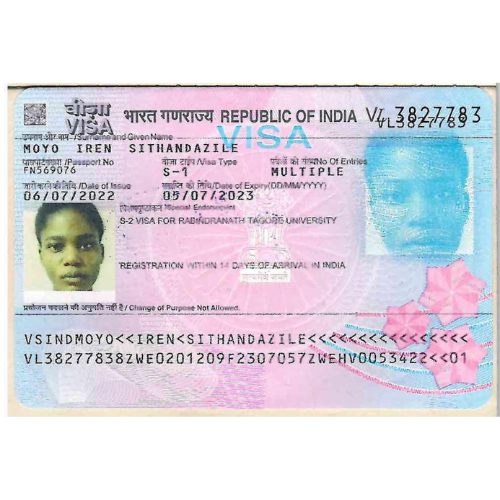

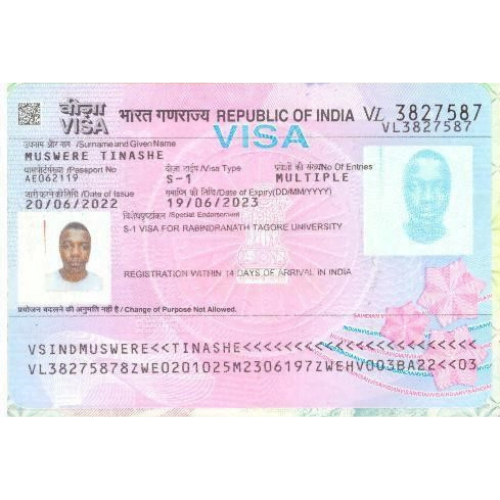

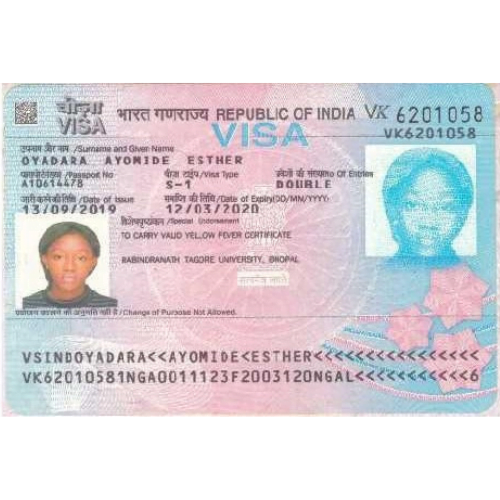

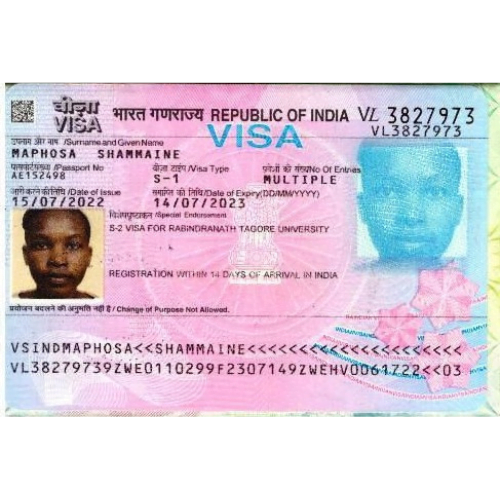

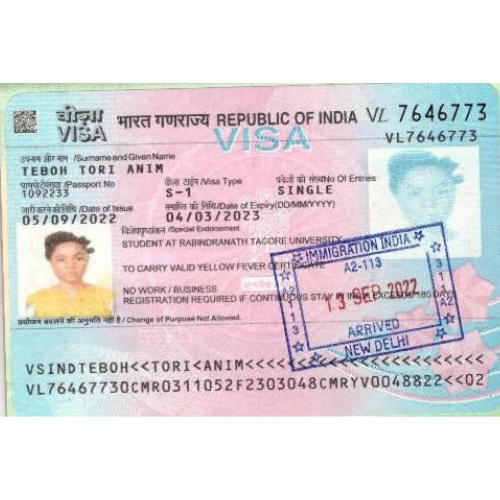

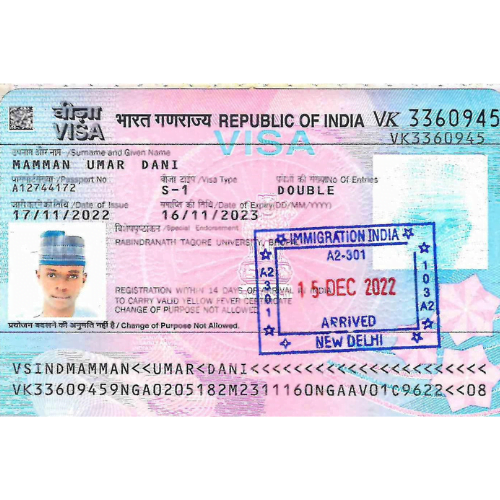

✔ Easy Admission & visa process

Schedule a Free Counselling Session

Easy 4 steps to Study in India

apply for admission

2

Get an offer of admission

3

Get an admission letter

4

Visa & Travel

What International Students Say About Studying in India?

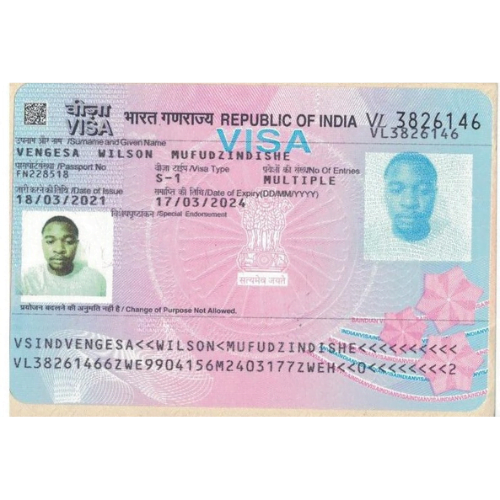

Wilson Mufudziwashe

Zimbabwe

I am finishing my graduation this year and I am grateful to my family & university for all the support.

Aya Bouare

Mali

I come from Republic of Mali – West Africa India is such a wonderful country to study & learn.

Mtandazi Rutendo Pauline

Zimbabwe

India is best place to Study Information Technology & I do the same. Thank you for all the support & love.

Yunusa Yahaya Yunusa

Nigeria

Yes, I Study in India. I will make my country & people proud.

Aliyu Umar Kamba

Nigeria

It’s an institution that will accelerate you to achieve your dreams and aspirations.

Alhaji Khaleel Ibrahim

Nigeria

I am studying Bachelor of Engineering in Computer Science. At my first visit to the university, I was impressed with Computer Lab, AI Lab, CS Lab & many more.

Yusuf Abubakar Sadiq

Nigeria

I was studying in Uganda when I saw this opportunity offered by Eduzina.com I am thankful for wonderful support I received.

Aliyu Nasiru

Nigeria

After a lot of research,I concluded to Study in India and I am proud of my choice.

Ebiau Peter Carlos

Uganda

I would like to tell that it was the best decision of me to choose eduzina.com to get up to 100% scholarship.

Helping students Since 2011

Made a Benchmark to provide over 100+ fees exemption opportunities to International Students in 2021.

Our Students

Alusine kallon

Sierra Leone

Josam Banda

Zambia

Yusuf Muhammad Bashir

Nigeria

Gumisiriza Samuel

Uganda

Maumsamatha chilasa

Malawi

Jafali Kwenda

Malawai

Yatu Kadiatu Koroma

Sierra Leone

Abdirizak ibrahim mohamed

Somalia

MOHAMED SIDIE KAMARA

Sierra Leone

Auwal Muhammad Zango

Nigeria

Zainab Ibrahim

Sierra Leone

Ishak Yusuf Bello

Nigeria

Nuraddeen Usman Muhammad

Nigeria

Kawsu Dibasey

Gambia

Junisa Joshua Sallu

Sierra Leone

Umaro Musa Bah

Sierra Leone

Andrew sikaumbwe

Zambia

Kpaka Mustapha Senior

Sierra Leone

Audu Adebayo

Nigeria

Lamin B Sanneh

Gambia

Yusuf Hajara

Nigeria

Muhammed keita

Gambia

Adama Njie

Gambia

Momoh Mark

Sierra Leone

laminatu H Koroma

Sierra Leone

Mohamed Bangura

Sierra Leone

lamin katta

Sierra Leone

Andrew Mendy

The Gambia

Julius Mumbinu

Sierra Leone

Mikail Ishaq

Nigeria

Emmanuel Komrabai

Sierra Leone

Fatmata Fofanah

Sierra Leone

Auwal Yunusa Hassan

Nigeria

Alhaji osman Bah

Sierra Leone

Saffa Kamara

Sierra Leone

Williams Abbey

Nigeria

Bangalie Mansaray

Sierra Leone

Isyaku Adam

Nigeria

David Hope Awariya

Nigeria

Sellu Ngevao

Sierra Leone

Olowo Michael

Uganda

Amphal Jobarteh

Gambia

Moses Dauda

Sierra Leone

Landing A sallah

Gambia

Abdulai Dumbuya

Sierra Leone

Richley Mendy

Gambia

Adnan Abdirashid

Somalia

Umar Rabiu

Sierra Leone

Giving Wings to Students Careers

Make the most of your higher education and get access to world-class academic opportunities in India with Eduzina’s competitive fee exemption opportunities and visa consultancy services. With up to 100% financial coverage, you can now study in friendly, supportive and motivating environments without any worry. Transform your dreams into reality with Eduzina!